Rail Vision (Nasdaq: RVSN) has been making significant strides this month, witnessing a remarkable uptick in its stock market performance. The company’s share price saw a dramatic increase this January, an astounding 877%, driven by a series of positive developments and groundbreaking announcements. As we revisit our previous review on Reddit, it’s crucial to reflect on this substantial momentum and its implications for Rail Vision’s future. here is a previous Reddit review about RVSN.

“You may all may remember me as that rando who keeps talking about Railvision (NASDAQ: RVSN), which develops computer vision and autonomous driving technology for passenger and freight trains. Think Mobileye $MBLY but for railways.

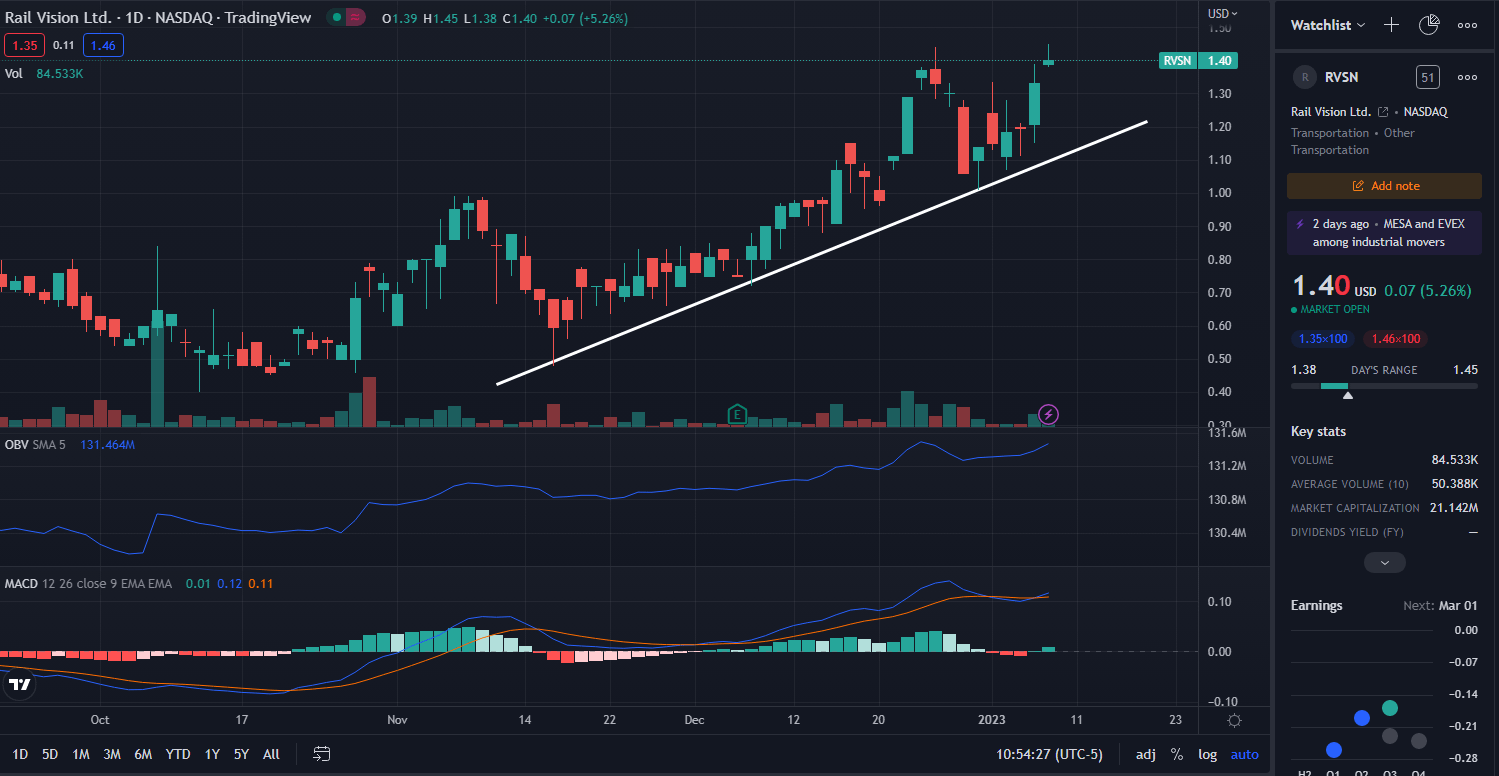

But I digress. Look at the chart. RVSN only listed in March ’22 at ~$3, and then followed the trajectory of most recent IPOs downwards. They bottomed out at $0.40 in early Q4, and since have begun an inspiring climb. Riding a solid ascending support, its trading above the 20/50/200 SMAs and OBV shows a very significant uptick in BUY volume since mid-November, shortly after bottom in late October/mid-November. Slap on MACD and any other momentum indicator of your choice, and you’ll see that in the short-to-intermediate term, there’s is some real bullish energy behind RVSN.

Now for the million-dollar question–why? The true answer–no idea. But here are some theories:

• It looks like today’s pop in volume was generated by an NR about the successful completion of a POC for AI-driven obstacle detection tech (i.e. autonomous driving trains). This was for a switchyard in the US, and the test received GoA4 status, which is the highest level of automated train operations. This follows a similar POC performed for Rio Tinto (ASX: RIO) in the Never Never (Aussie outback) for a long-haul freight train carrying ore to port that concluded end-Q3. Both of these successful POCs in countries (the US and Australia) with extensive and ageing rail infrastructure is cause for optimism regarding RVSN’s eventual go-to-market. They’re still pre-revenue for the most part, but if you’re in for the long game these two POCs are not something to ignore.

• Insiders still own ~55% of RVSN shares with low institutional ownership and a low short ratio (1.11, or 0.46% of total float). That means that either insiders are quietly buying in order to beef up positions and SP before something big, or that retail is catching a whiff of this play and hopping onboard. I think $MBLY’s slick listing and gains since October testify to the market’s demand for computer vision solutions despite the bloodbath other tech equities have undergone in the past year”.

Full disclosure: since my last post about RVSN I entered 10k shares and am already looking at 40% upside after a 2 week hold. That PT of $7 ain’t looking so far off all of a sudden. DYOR, and if anyone has other takes on whats going on here and where RVSN is headed feel free to jump in.