Rail Vision (Nasdaq: RVSN) has been attracting attention recently, and we wanted to examine whether the company’s stock represents an investment opportunity. Here is an interesting post that appeared this year on Reddit about the company:

Why I’m Long on Rail Vision (NASDAQ: RVSN)

After 2022’s effective cratering of the smallcap equities market, viable plays with multibagger potential are far and few between. Rail Vision Ltd. (NASDAQ: RVSN) is one microcap that bucks the trend and appears to be positioning itself for an explosive start to the new year. I’ve seen some recent posts discussing its >300% rally since bottoming out in October, and decided to do some proper due diligence on this play. Here it goes:

Company Overview and Industry

Rail Vision was incorporated in Israel in 2016 and listed on Nasdaq back in March 2022. The company develops advanced computer vision and sensor technology that can be mounted on a variety of trains–from industrial freight to passenger speed trains–to increase passenger safety, prevent on-track collisions, detect obstacles, and augment railway’s level of self-driving autonomy to make them more efficient and less dependent on human operators.

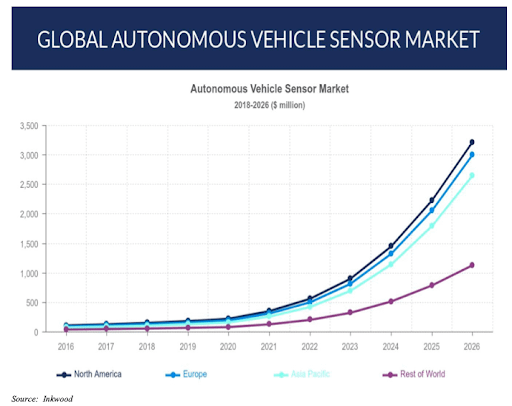

Given its high-tech approach to a classic industrial market segment (i.e. railways), Rail Vision straddles two industries with robust growth forecasts in coming years. In terms of global railway infrastructure, authorities in both the EU as well as US have emphasized the need for modernizing and revitalizing national rail networks. Generous government subsidies are greasing the wheels of this process, meaning that in coming years ample funds will be flowing from the public to private sectors in order to promote much-needed upgrades to rail infrastructure, and Rail Vision’s stands to directly benefit from such investments.

Rail Vision’s value proposition emerges from its strong positioning in the autonomous driving/computer vision industry, which has likewise enjoyed a windfall over recent years and expects double-digit CAGR through the decade. One testament to the momentum currently driving the autonomous vehicle market is Mobileye’s much-anticipated IPO on NASDAQ in October ‘22. Despite a historically poor year for tech equities on top of truly appalling macroeconomic conditions, Intel’s golden goose acquisition is +16% with impressive and ongoing buy-side demand. In a sense, Rail Vision can enjoy the best of both worlds via its development of disruptive machine vision tech for a reliable industrial niche.

2022 Market Performance and Comparison

What initially caused me to add RVSN to my watchlist was the bull run it’s been tracking since hitting a low of $0.40 on October 12th. Over Q4 and so far into Q1, RVSN has come roaring back with almost 300% growth for a close of $1.56 on Friday. The past three months have likewise been punctuated by multiple days where trade volume was >2X 3mo average volume, indicating a clear uptick in investor demand.

In the background, modest gains for NASDAQ and a strong Q4 performance for the DJI provided wind in the sails of RVSN’s run. Mobileye, a future computer vision competitor, likewise has enjoy double-digit gains since its October IPO, while Luminar Technologies (NASDAQ: LAZR) shares were down a whopping 63% in 2022 as overhyped tech valuations came crashing back to earth. That said, strong Q3 earnings has helped LAZR bounce >50% from a bottom of $3.91 on January 6th. Compared to MBLY and LAZR, RVSN is clearly outperforming.

Interestingly, two pure railroad plays–CSX and NSC–are also up +17% and +16%, respectively, since the start of Q4 as industrials finished the year out strong. Though comparing Rail Vision price action to CSX or NSC is like apples to oranges, it’s useful in illustrating the bullish sentiment and macro-trends driving railroad stocks, including RVSN, upwards.

Technical/analyst ratings

Given its performance over the past month, it should come as no surprise that technical ratings for RVSN at the one-month horizon are a buy across all parameters.

Analyst coverage of RVSN is a bit more telling, particularly for a more long-term time frame. According to Aegis Capital, which initiated coverage for RVSN in Q2 ‘22, by 2025 Rail Vision “can generate at least $30 million annually from the sale of fully operational vision systems to major global locomotive producers, as well as from ongoing maintenance contracts.” On the basis of this calculation, they project a Diluted EPS of $0.17 in 2025 with overall profitability. Using an enterprise Value/2025E revenue multiple of 3X model, Aegis issued a 12-month price target of $7, representing roughly 400% upside for current shareholders.

Strategic Investors

When considering a deeptech developer like Rail Vision where the R&D process is expected to take years, short term profitability is an irrelevant variable on which to inform a LT play. More telling for me are the strategic investors that are likely going to be helping bankroll operations until future profitability. In Rail Vision’s case, the strategic investors lined up behind them are a cause for optimism. They include:

• Knorr-Bremse (XTRA: KBX): KBX is to train manufacturing what Microsoft or Apple are to computers, and I don’t think Rail Vision could have asked for a better strategic partner than Knorr-Bremse. This German industrial blue chip has invested more than $20 million in RVSN and currently has a ±30% stake in the company. With an annual turnover of $7 billion and operations in over 30 countries, Knorr-Bremse not only brings with it significant resources to the table in ensuring RVSN’s go-to-market, but can also provide a big boost to the company in gaining contracts with other leading players in the field.

• Foresight Autonomous Holdings (NADAQ: FRSX): Foresight develops machine vision and autonomous driving technology for a range of different vehicles. Whereas KBX is the king of railroad manufacturing, FRSX is considered a rising disruptor in the computer vision field alongside LAZR and MBLY. As of May ‘22, Foresight held a 16.7% stake in RVSN, i.e. about ½ of KBX’s share.

Successful POCs

The make-or-break moment for any emerging technology developer is if they succeed in going-to-market. Two recent updates are encouraging in this regard and demonstrate the viability of Rail Vision’s technology, while illustrating the diversity of potential applications.

In September, Rail Vision completed a pilot project with mining giant Rio Tinto (ASX: RIO) for the world’s first automated, long distance, heavy haul rail network. Rail Vision’s machine vision technology was successfully used to fully automate a freight network stretching across 1,700km of track in the Australian outback to bring metal ores to port. According to the report, both parties are continuing to explore additional applications of RVSN’s industrial freight tech to RIO’s sprawling global operations. With nearly $65B in revenue for 2021, Rio Tinto is a potential heavy-hitter in terms of kickstarting initial deal flow for RVSN.

Last week Rail Vision completed another successful POC for its SwitchYard System for a Class 1 North American railroad. Therein, its AI-based obstacle detection system was showcased on a SD40 locomotive in low-visibility conditions and achieved GoA4 status, the highest level of automated train operations. Both of these recent POCs are a strong indication that the tech pipeline is progressing and has future applicability to both industrial/freight as well as passenger rail networks for a larger combined TAM.

Conclusion

want to make it clear that Rail Vision is currently a pre-revenue company and therefore any investment is, at least to some extent, speculative. That said, the mega-trend of computer vision and autonomous driving vehicles has been widely identified as a leading technology trend through 2030. For event-driven traders, public sector commitments to fundamentally modernize and upgrade US and European rail infrastructure is another bullish trend to consider while strategizing LT plays for RVSN. On the basis of its value proposition, recent performance, strategic investors, and successful POCs, I’m long on RVSN. Finis.