The world of investment has seen a significant evolution with the emergence of cryptocurrency. Often considered the “money of the future”, it has managed to captivate a considerable amount of attention due to its explosive growth and promising investment potential. However, as with any investment, there are certain risks associated with this novel form of digital asset.

In this article, we delve deep into the risks of cryptocurrency investment, offering a balanced view for both existing investors and those considering a plunge into this digital world.

Understanding Cryptocurrency

Before we unpack the risks, it’s crucial to understand what cryptocurrency is and how it functions. In simple terms, cryptocurrency is a type of digital or virtual currency that utilizes cryptography for security. The most well-known among them, Bitcoin, set the stage for what is now a burgeoning market of digital currencies. These cryptocurrencies operate on decentralized platforms known as blockchain, a distributed ledger enforced by a disparate network of computers.

Cryptocurrencies appeal to their supporters for various reasons. Some like the idea that these currencies could one day undermine traditional banks and monetary systems. Others are drawn to the potential for a significant profit, given the meteoric rise of cryptocurrencies like Bitcoin and Ethereum over the past few years.

Cryptocurrency Investment: The Potential Rewards

Cryptocurrency investment holds immense potential. Over the past decade, it has generated substantial returns for some investors. For instance, if you had invested just $1 in Bitcoin in 2010, it would have been worth millions at its peak in late 2017. Stories of ‘Bitcoin millionaires’ have often been highlighted in the media, attracting a plethora of investors worldwide hoping to make similar profits.

Besides the potential high returns, cryptocurrencies also offer an opportunity for diversification. As they are somewhat decoupled from the traditional financial markets, they can act as a sort of “hedge” against market downturns in other sectors.

However, while the rewards may be substantial, they do not come without significant risks. As we venture further, we will examine the potential risks associated with cryptocurrency investment, offering insights for anyone considering this form of investment.

The Other Side of the Coin: Risks in Cryptocurrency Investment

As compelling as the potential rewards of cryptocurrency investment are, it’s essential not to overlook the inherent risks associated with this venture. Some of the most prominent risks include extreme market volatility, regulatory uncertainties, security vulnerabilities, and the risk of fraud and scams. Furthermore, the lack of consumer protection mechanisms, and the fact that cryptocurrency transactions are irreversible, add an extra layer of risk.

Market Volatility and Investment Risk

Perhaps one of the most distinguishing features of the cryptocurrency market is its notorious volatility. The prices of cryptocurrencies like Bitcoin and Ethereum have been known to fluctuate wildly within short periods. For instance, Bitcoin’s price surged from around $1,000 in January 2017 to nearly $20,000 in December of the same year, only to plummet to below $4,000 by the end of 2018. This extreme volatility can lead to massive gains, but equally, it can result in substantial losses, posing a considerable investment risk.

The high volatility in the cryptocurrency market can be attributed to several factors. These include technological changes, market demand and supply imbalances, regulatory news or events, and macroeconomic trends. Because of this volatility, investing in cryptocurrencies can feel more like gambling than investing, and it’s not for the faint-hearted.

Regulatory and Legal Risks

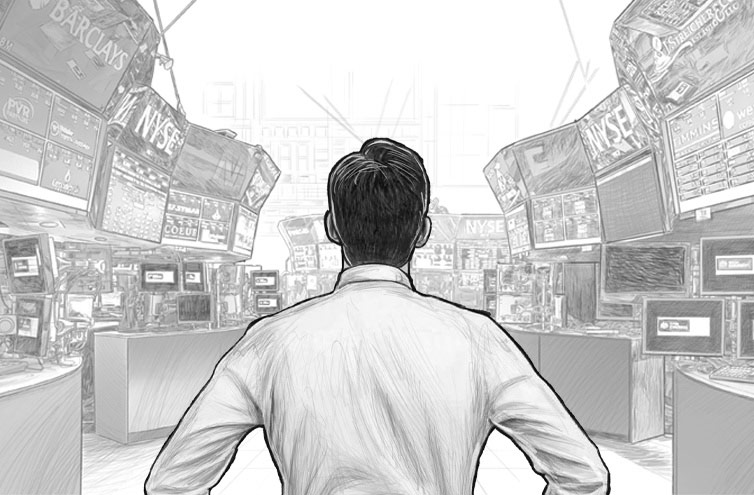

The regulatory landscape for cryptocurrencies remains largely uncertain and can vary significantly from one jurisdiction to another. Some countries have embraced cryptocurrencies, while others have outright banned them. In some places, the regulatory status of cryptocurrencies is still unclear, leading to uncertainty for investors.

Regulatory changes can significantly impact the value of cryptocurrencies. For example, when China announced a crackdown on cryptocurrencies and initial coin offerings (ICOs) in 2017, it led to a sharp fall in global cryptocurrency prices.

Additionally, as cryptocurrencies have been associated with illicit activities due to their anonymous nature, investors could potentially find themselves inadvertently violating anti-money laundering (AML) and combating the financing of terrorism (CFT) laws. Therefore, understanding the legal and regulatory risks is a crucial aspect of investing in cryptocurrencies.

Technological and Security Risks

The decentralized and digital nature of cryptocurrencies brings about a unique set of technological and security risks. One significant risk in the cryptocurrency space is the vulnerability to hacking. Even though blockchain technology, which underpins most cryptocurrencies, is considered highly secure, the exchanges where these coins are bought, sold, and stored are not impervious to breaches. Numerous high-profile hacking incidents have resulted in investors losing millions of dollars worth of cryptocurrencies.

Furthermore, cryptocurrencies are susceptible to fraud and scams, including Ponzi schemes, pump-and-dump schemes, and fraudulent Initial Coin Offerings (ICOs). There’s also the risk of technical failure. Given that cryptocurrency systems are still relatively new, they could fail due to technical glitches, potentially leading to a total loss for investors.

Risk Management Strategies in Cryptocurrency Investment

In light of these risks, it’s imperative to adopt risk management strategies when investing in cryptocurrencies. Diversification, or not putting all your eggs in one basket, is one strategy. This involves spreading your investments across different types of assets, including cryptocurrencies, stocks, bonds, and real estate.

Investors should also only invest what they can afford to lose. Given the volatility and uncertainty of the cryptocurrency market, there’s always a chance that investments may not pan out as expected. It’s also essential to stay informed about the latest market trends, news, and regulatory developments.

Finally, investors should consider seeking advice from financial advisors or professionals who are familiar with cryptocurrencies and their associated risks. This guidance can be invaluable, especially for those new to the world of cryptocurrencies.

Conclusion

Understanding the risks of cryptocurrency investment is crucial for anyone considering this venture. From market volatility to regulatory changes, technological vulnerabilities to potential fraud, the cryptocurrency landscape can be a minefield. However, with careful consideration, informed decision-making, and appropriate risk management strategies, investors can navigate these risks and potentially unlock the rewards this innovative asset class has to offer.

Always remember that while the prospect of high returns is alluring, the stakes can be equally high. Therefore, proceed with caution, stay informed, and make sure you’re fully aware of the risks before diving into the world of cryptocurrency investment.